December Market Commentary

Waiting for the Data

November Recap and December Outlook

The shutdown is over, but it’s taking time to get the data flowing again. September data will likely be available in early December, and October will be combined with November on a mid-December release. The Federal Reserve wraps up the year with an early December meeting, at which consensus expectations are for a likely quarter-point interest rate cut.

With the absence of official data, private sector data from ADP and other sources is attempting to fill the gap.

It's been an eventful year, and the ongoing difficult economic backdrop that includes tariffs, slow progress on normalizing interest rates and a very cautious consumer is beginning to create a bifurcation between how large and small businesses are holding up.

Let's get into the data – what there is of it:

- The shutdown meant no government labor statistics. The Chicago Fed’s estimate of the unemployment rate, which combines public-sector with private-sector data, fell slightly from the October estimate, to 4.44% from 4.46%.

- Looking only at private-sector employment, ADP reported a loss of 32,000 jobs in November. This reverses the gains in October and returns to the trend of contracting labor market data.

- The University of Michigan Consumer Sentiment Index rose by 2 percentage points. Upward movement is a good sign, but it is still off a very low reading. Labor market expectations remained “dismal.”

- The Atlanta Fed’s GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2025 is 3.5 percent.

What Does the Data Add Up To?

The Fed’s final meeting of the year will likely bring a 25 basis point rate cut, which investors have pretty much priced into the markets.

A conservative cut looks prudent, given that the famously data-driven Fed under Chairman Powell is making the decision without access to much of the traditional government data. If enacted, this will mark the third cut in 2025, following 25 basis point cuts in September and October.

Attention now turns to 2026, and the path of rates is not exactly clear. Payroll processor ADP reported the loss of 32,000 jobs in November, and all of those losses were from firms with fewer than 50 employees. The pressure isn’t just on cutting labor. A recent Bloomberg report found that bankruptcy filings for small businesses, under a federal program called Subchapter V that allows companies to shed debt more quickly, are at a higher level than at any point in the program’s six-year history.

Large companies have more resources and so far have been able to backstop the labor market. Small companies are much more vulnerable, and the impact of shedding jobs and closing their doors may be more difficult to undo, even if the Fed determines it is necessary to cut rates more quickly in 2026.

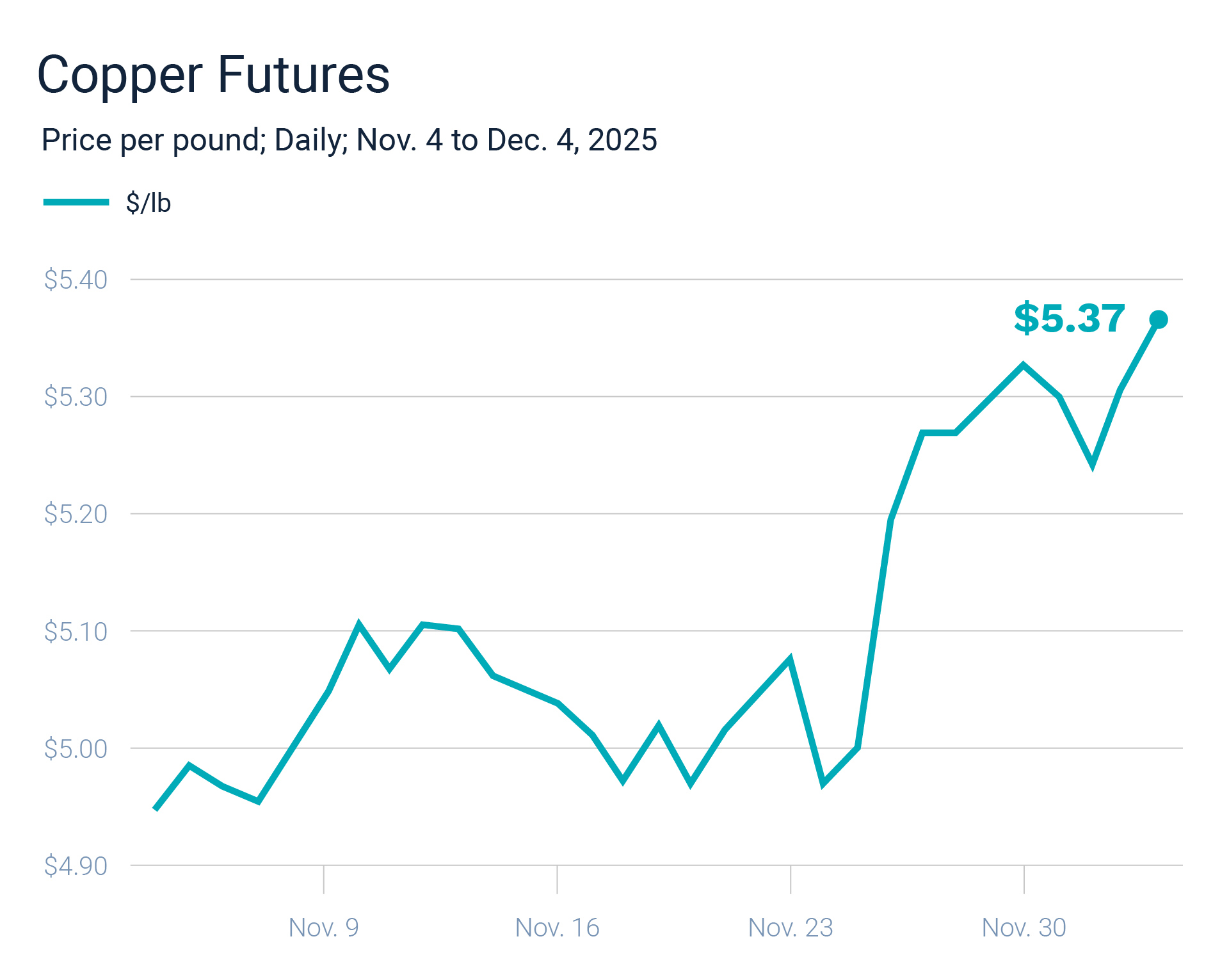

Chart of the Month: Copper Prices Rally

Copper is sometimes called “Doctor Copper,” as the metal is used so broadly that it can be seen as a barometer of the health of the economy. Increased demand is usually interpreted as a sign that the economy is growing. This time, however, it is unclear if the demand is organic, or driven by worries over tariffs and supply chain disruptions.

Source: Axios

Equity Markets in November

- The S&P 500 was up 0.13%% for the month

- The Dow Jones Industrial Average gained 0.32% for the month

- The S&P MidCap 400 rose 1.92% for the month

- The S&P SmallCap 600 gained 2.51% for the month

Source: S&P Global. All performance as of November 30, 2025.

Eight of the eleven S&P 500 sectors had positive returns. Breadth was positive, with 324 issues gaining, up from 204 in October. Health Care was the strongest performer, up 9.14% for the month. Information Technology fell victim to profit-taking, ending the month down 4.36%, the second worst month of the year, behind March, for the sector. YTD, all eleven sectors are up as we go into the last month of the year. Communication services is the year-to-date leader, up 33.83%, and Real Estate is bringing up the rear at 2.51%

Bond Markets in November

The 10-year U.S. Treasury ended the month at a yield of 4.02%, down from 4.09% the prior month. The 30-year U.S. Treasury ended November at 4.67%, up from 4.66%. The Bloomberg U.S. Aggregate Bond Index returned 0.62%. The Bloomberg Municipal Bond Index returned 0.32%.

The Smart Investor

As you get to the end of the year, it’s a good time to think about your financial plan. What worked and what didn’t? What changes do you need to make? Think through:

Are you on track? Were there any big surprises or challenges that came up this year? Did you stick to your budget? This year was volatile. Did your plan provide peace of mind? Have any big expectations changed? For example, retirement dates, having one spouse reduce work, children needing more expensive education?

Your financial plan should include your goals, expectations and assumptions, a clear idea of the level of risk you are comfortable with, and both a strategic and a tactical asset allocation. As your situation and expectations change, your plan will need to be updated to keep you on track.

The information contained herein is intended to be used for educational purposes only and is not exhaustive. Diversification and/or any strategy that may be discussed does not guarantee against investment losses but are intended to help manage risk and return. If applicable, historical discussions and/or opinions are not predictive of future events. The content is presented in good faith and has been drawn from sources believed to be reliable. The content is not intended to be legal, tax or financial advice. Please consult a legal, tax or financial professional for information specific to your individual situation.

This content not reviewed by FINRA

Disclosure information

The strategies discussed are strictly for illustrative and educational purposes and should not be construed as a recommendation to purchase or sell, or an offer to sell or a solicitation of an offer to buy any security. There is no guarantee that any strategies discussed will be effective. The information provided is not intended to be a complete analysis of every material fact respecting any strategy. The examples presented do not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy. The information provided is not intended to be a tax advice. Investors should be urged to consult their tax professional or financial advisers for more information regarding their specific tax situations.