Tax Season Help Has Arrived

Greetings.

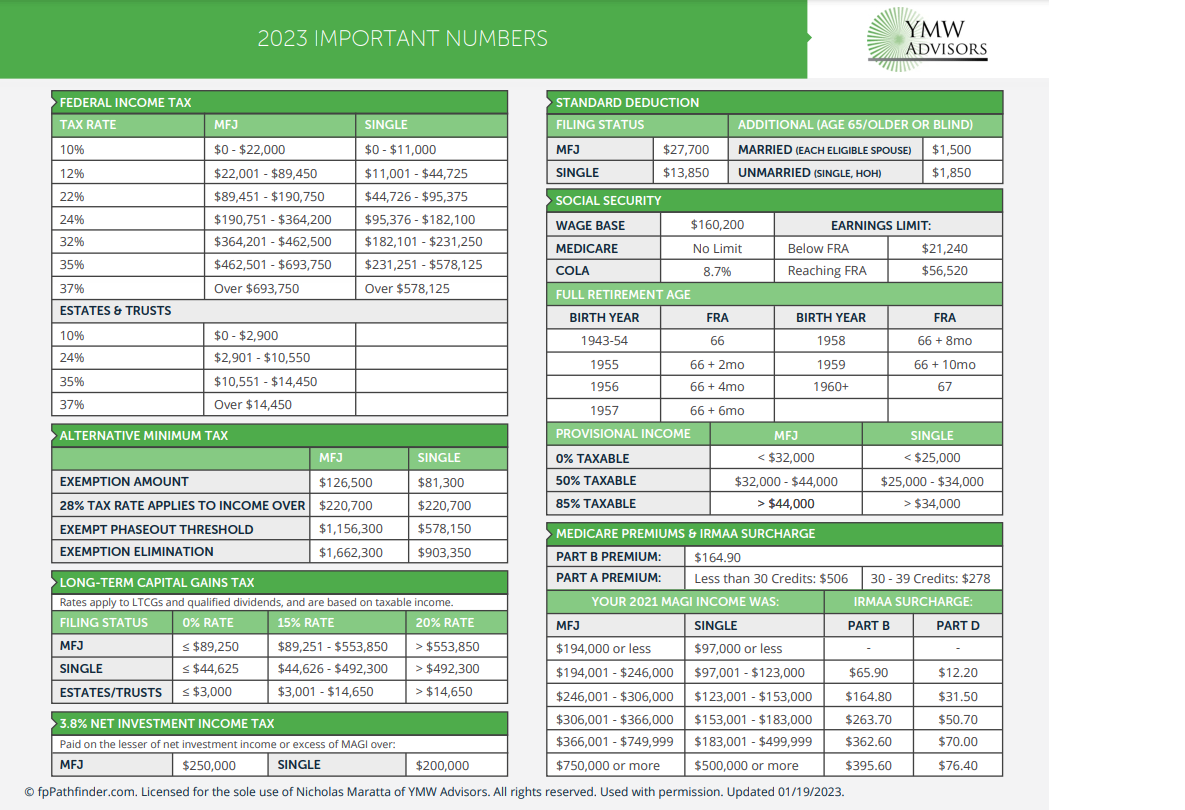

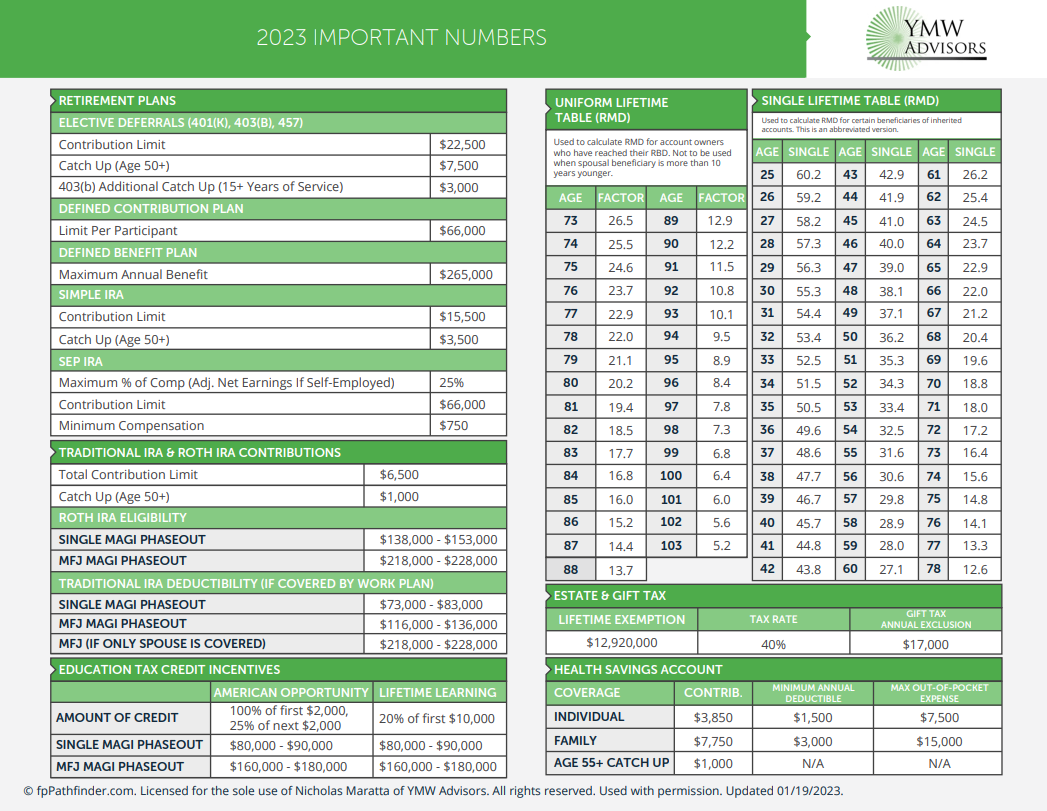

Very Important Numbers (click here)

.. As another tax season is approaching, we wanted to send a quick note and help out with a cheat sheet (above) to help answer some of the questions we frequently get. To clarify, these numbers are for 2023 tax guidelines and a resource to be used for tax planning 2023. Most of what is presented here is self-explanatory but a few items to point out would help as these are the areas, we typically see confusion at. If there are others, please feel free to reach out and let us know so we can improve this article based on your needs. As always, feel free to pass it on and/or let us know if you’d like to be taken off of our distribution list.

Here we go:

Let’s start with the estate and gift tax limits. For 2022, the lifetime estate exemption is $12,920,000, which means a person can gift or pass on in the form of inheritance a total of this amount, without it being subject to estate taxes. This amount can be doubled for a couple with proper estate planning.

In addition to this, a person can gift $17,000 to another without paying gift taxes. The key word here is “in addition”, meaning this annual exemption doesn’t count towards the lifetime exemption. Annual exclusion is per person and per year, so a couple can double this amount and apply it towards each of their kids. For instance, Jane and John can gift a total of $34,000 in 2023 to each of their 2 kids, a total of $68,000 without paying gift taxes and without lowering their life time exemption. It is also worth noting that this amount is applicable for 529 contribution limit calculations as well. Social security wage limit is quite straight forward, any earned income above $160,200 is not subject to social security tax (6.2% for the employee and the same amount for the employer) but it’s still subject to Medicare taxes (1.45%) which goes up another 0.9% for income of $200,000 for individual and $250,000 for joint tax filers. Here is another common confusion: your mortgage interest deduction is not part of the $10,000 deduction limit for state and local taxes (SALT). Your property tax is a part of SALT, but not mortgage interest. So, if your standard deduction is below the [$10,000, plus your mortgage interest deduction] it’s worthwhile to itemize your taxes. If not, it’s better to simply take the standard deduction, which is $27,700 for joint filers in 2023.

The last item to add here is the taxes on long term capital gains and dividends. Because most investors are in the $89,251 to $553,800 joint income bracket, it is widely shared and assumed that gains for securities held for more than a year are taxed at 15%, but here is the trick: if in a year your income is below the taxable income rate (which is adjusted gross income) you can clear your gains without paying capital gains taxes. So, it would be wise to consider looking at your highly appreciated stocks more closely in the years your income is above these limits.

We hope you’ll find this article useful for your 2023 tax planning and please feel to reach out with questions and comments.