October Market Commentary

October Market Commentary

Is the Market Tuning Out Noise or Ignoring a Warning Siren?

September Recap and October Outlook

After a pause in interest rate cuts since the last cut at the December 2024 FOMC meeting, the Federal Reserve finally reduced rates by 25 basis points at the September meeting.

Chairman Powell described the decision as a “risk management cut” as they finally got off the balance beam between continuing to prioritize keeping inflation low while depending on what has been a strong labor market to maintain economic momentum. The risk of a sudden economic slowdown became greater as it became clear that the labor market has weakened over the last several months.

The Fed minutes, which came out on October 8th, provided more color on the Fed’s thinking and revealed that most of the Fed officials think further cuts will be enacted this year.

Let's get into the data:

- The shutdown meant no government labor statistics. Private sector ADP data showed a loss of 32,000 private sector jobs in September. The jobs listing site Indeed reported overall job postings were down 2.5%.

- The Institute for Supply Management Services Index fell 2 percentage points. The index now reads 50%, the breakeven point between expansion and contraction.

- The University of Michigan Consumer Sentiment Index declined by 21.4% versus September 2024. At 55.0, it is now lower than it was during 2008-2009.

- Personal spending rose 0.6% in August. The strong result was mostly due to durable and non-durable goods.

What Does the Data Add Up To?

Consumers are pessimistic about the economy but continue to spend. The labor market has clearly slowed, and wage growth has stalled. Inflation is lower, but consumers are still pinched by the massive inflation of the last several years and have not seen any real relief in their grocery bills. Tariff wars, geopolitical uncertainly, and a crackdown on undocumented immigrants have been wild cards whose impact on the economy has been anticipated to be negative. A recent study by the chief economist of Moody’s Analytics using state-level data found that 22 states are either in recession or on the brink of a downturn.

That’s the pessimistic view. On the positive side, GDP rose at 3.8% in the second quarter, and the Atlanta Fed’s GDPNow model is predicting a 3.8% increase for the third quarter too. The markets are taking note. Powell’s comment that he is cutting rates as risk management has been interpreted to mean that the overall economy is not entering recession and that the cuts are meant to support the jobs market.

The long end of the yield curve – the canary in the coal of economic indicators – isn’t steepening drastically, which can be interpreted as a sign that the bond market supports the current path and pace of interest rates. There seems to be a belief that while the fourth quarter may be rocky, 2026 brings the potential for more growth and a sustained path forward to turn in the economic cycle for the better.

The government shutdown added one more wild card to our already full deck. It has temporarily stopped the all-important flow of data, but on Friday October 10, the Bureau of Labor Statistics announced that CPI inflation will be released on October 24th, moved from the original release date of October 15th. Staff were called back to complete work on the data, because the September CPI number is used to determine the annual increase in Social Security benefits, which is pegged to inflation. The statutory deadline for the COLA announcement is November 1, making the October announcement of September data critical. This may give the markets some semblance of normality.

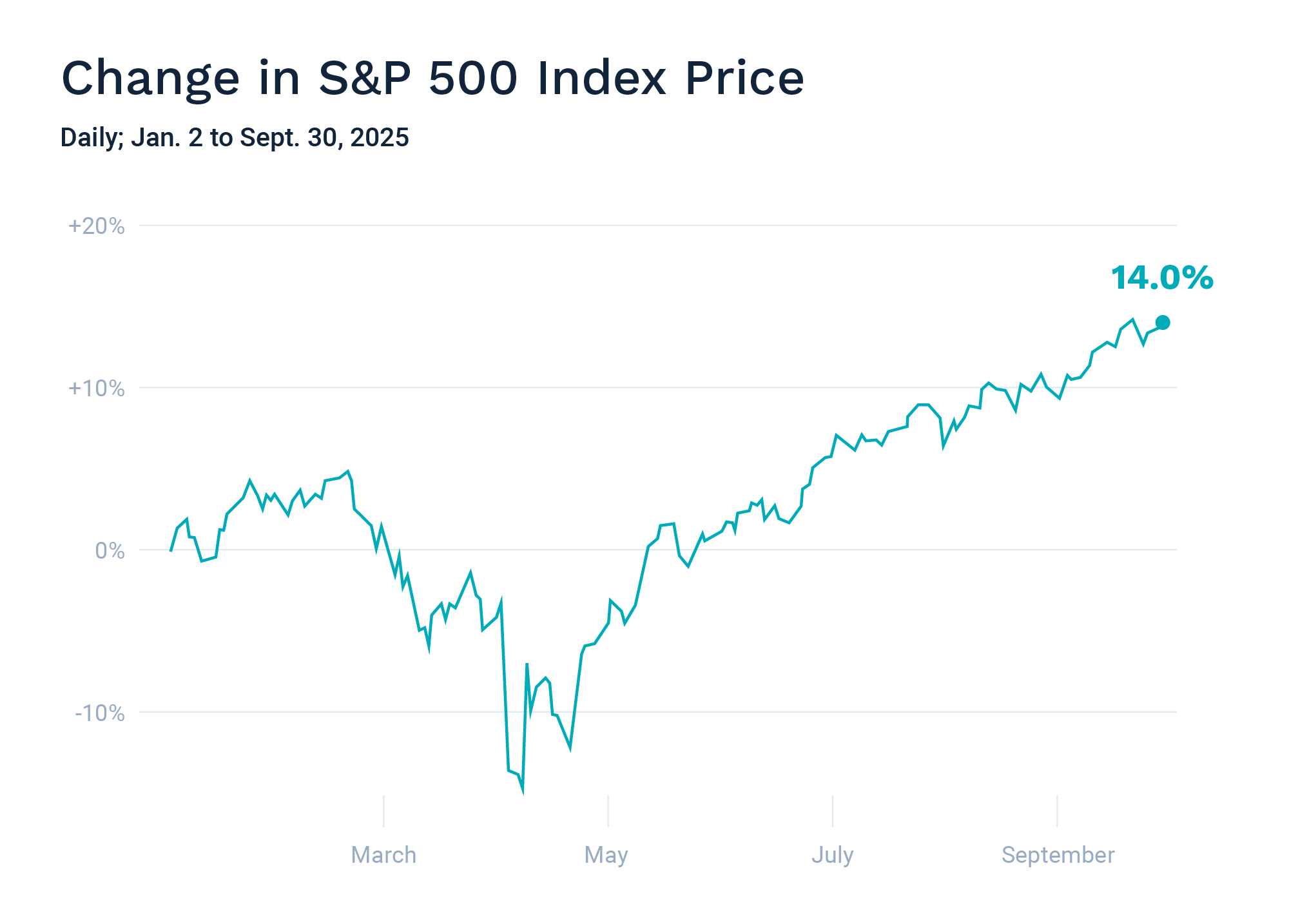

Chart of the Month: Equities Are Marching to Their Own Drummer

Equity Markets in September

- The S&P 500 was up 3.53% for the month

- The Dow Jones Industrial Average gained 1.87% for the month

- The S&P MidCap 400 rose 0.29% for the month

- The S&P SmallCap 600 increased 0.80% for the month

Source: S&P Global. All performance as of September 30, 2025.

Seven of the eleven S&P 500 sectors had positive returns, with Information Technology back in the lead with a 7.21% return. Materials were in last place, down 2.31%. Volatility is down to 0.69%, from 0.77% in August. This can also be seen from a different angle in the number of trading days moving at least 1%. September saw none of its 21 trading days moving at that level.

Bond Markets in September

The 10-year U.S. Treasury ended the month at a yield of 4.16%, down from 4.23% the prior month. The 30-year U.S. Treasury ended September at 4.74%, down from 4.94%. The Bloomberg U.S. Aggregate Bond Index returned 1.09%. The Bloomberg Municipal Bond Index returned 2.32%.

The Smart Investor

As we head into year-end in a year end, the most important things are the basics. Headlines come and go, but don’t necessarily have a long-term impact. More important is to keep your plan up to date. The IRS issued new guidance on the catch up contribution for those age 50 and older. Beginning in 2026, employees age 50 or older whose wages exceeded $145,000 in the previous calendar year must make all catch-up contributions on an after-tax Roth basis. For those 60 to 63 who are eligible for the “super catch-up”of up to 150% of the standard catch up amount, this is an opportunity to meaningfully increase retirement savings, even if it doesn’t come with a tax benefit.

The advantages of the Roth IRA are clear, and opening a Roth to make these contributions can be useful later when converting to a Roth in retirement. There are tax implications, so understanding the nuances will be critical to a successful plan.

Taking a careful look now and then planning for year-end can help you implement a tax strategy that keeps you on track for your wealth goals.

The information contained herein is intended to be used for educational purposes only and is not exhaustive. Diversification and/or any strategy that may be discussed does not guarantee against investment losses but are intended to help manage risk and return. If applicable, historical discussions and/or opinions are not predictive of future events. The content is presented in good faith and has been drawn from sources believed to be reliable. The content is not intended to be legal, tax or financial advice. Please consult a legal, tax or financial professional for information specific to your individual situation.

This content not reviewed by FINRA

Disclosure information

The strategies discussed are strictly for illustrative and educational purposes and should not be construed as a recommendation to purchase or sell, or an offer to sell or a solicitation of an offer to buy any security. There is no guarantee that any strategies discussed will be effective. The information provided is not intended to be a complete analysis of every material fact respecting any strategy. The examples presented do not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy. The information provided is not intended to be a tax advice. Investors should be urged to consult their tax professional or financial advisers for more information regarding their specific tax situations.