The Russian Invasion of Ukraine

The invasion of Ukraine is distressing on a humanitarian level and our hearts go out to the individuals and families who are being impacted by this crisis - both directly and indirectly.

Witnessing this trauma unfold can be quite unsettling. It’s also normal to worry about the impact of such a tragedy on one’s life savings, family’s financial security, and investment portfolios.

Fear creates market drops. And the world is nervous. We can’t predict the future. But we can learn from the past and present to help guide us forward.

THE PAST

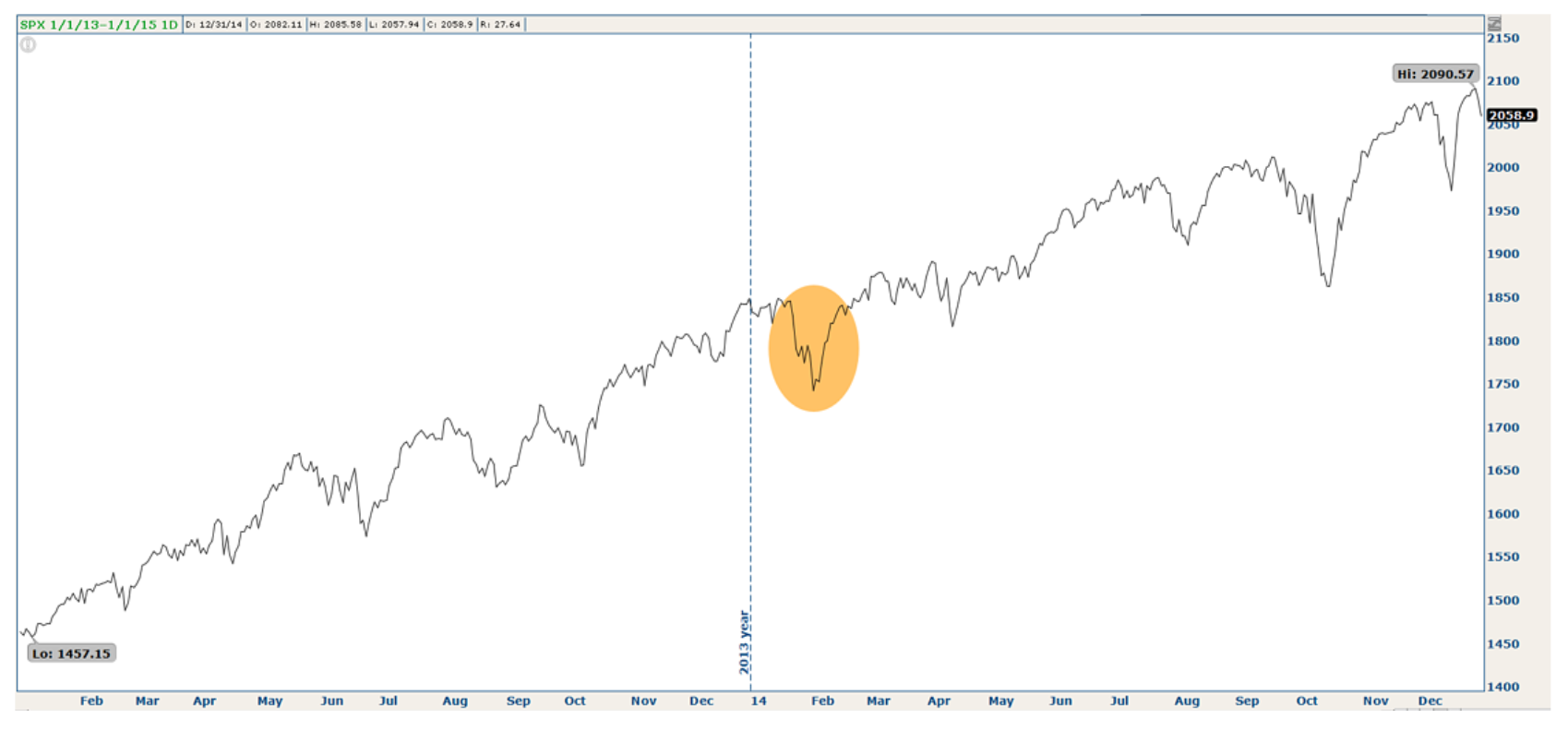

The S&P 500 took a hit after the Russian Invasion of Crimea in January 2014, which led to a 5.68% drop. However, the market had fully recovered just 25 days later and ended the year up over 13%.

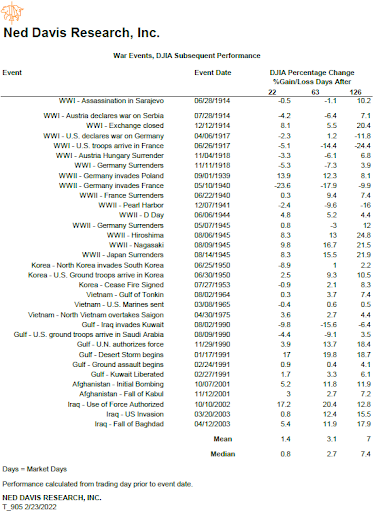

We can also gain some perspective by looking at the DJIA performance in the days after war events dating back to the 1900s. As you can see in the table below, the market takes a hit in the early days but on average is back up in the 22-day (+1.4%), 63-day (+3.1%), and 126-day (+7%) time periods after the event.

THE PRESENT

Added to already high inflation and the market's uncertainty around the Federal Reserve's future interest rate increases, markets are now reeling from the added pressure of what could be more aggressive sanctions.

Here are some of the threads we're tracking:

The Fed

The markets have been reacting to high inflation and the impact on Fed rate increases, with an expectation for a 50-basis point increase in March. The Fed has worked to be transparent in its messaging and comments from N.Y. Fed Chairman Williams and Governor Brainard were clear that the new expectation is that the Fed will raise rates by 25 basis points at the March meeting.

Like the rest of us, the Fed has undoubtedly been monitoring the situation in Ukraine very closely. The Fed has been committed to monitoring the data and telegraphing potential moves to markets ahead of time. It is also retaining options to help keep markets and the economy on as even a keel as possible.

Inflation

Oil prices pushed above $100 a barrel for the first time since 2014. While this will benefit oil producers, it will complicate the inflation picture and hit already high prices at the pump. It may, however, be short-term. If the conflict resolves – or another producer of oil is found, such as Iran, the spike in oil prices could be temporary.

Markets Have Shifted to “Risk-Off”

Equity markets have dropped and may see further volatility, with the VIX (the so-called Fear Index) opening at 37 Thursday morning, an increase from Wednesday’s close of 31. A reading above 20 indicates increased volatility. As of Thursday’s close, it had fallen to 30, as investors processed the likely impact on markets. The bond markets are now seeing a drop in yields as investors flee to less-risky assets and push prices up. This is a reversal of what we saw earlier in the week, as the Fed news on rates pushed yields up. Bond prices largely closed negative in January, and the return to less risky assets – if it continues - may lift bond performance.

THE FUTURE

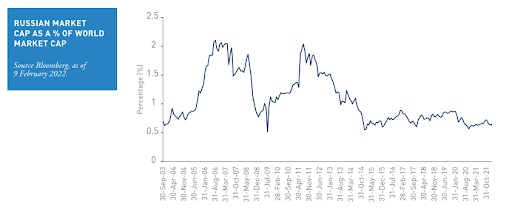

A surge in oil prices could slow economic growth. But a recession in Russia is not likely to have a big impact on the rest of the world, as Russia’s Market cap as a percentage of the world's market cap is under 2%.

Your long-term financial plan is built to withstand shocks like these. While we can't know the full impact of the invasion or the duration of the crisis, increased inflation and extended supply chain disruptions have been part of the ongoing picture. Taking a cue from the Federal Reserve's playbook of waiting to get data and let geopolitical tensions settle before making big moves with long-term impact, has maintained the test of time.

We will continue to monitor the situation and its impact on our clients’ financial lives. We are always here to answer any questions or just have a conversation.

We hope you and your family are safe and well,

Your Mental Wealth Advisors Team