The Optimal Retirement Withdrawal Plan

How do you know how much to withdraw from your accounts so that you can create the life you want, but you don't inadvertently overspend and end up depleting your savings before your retirement is over?

It turns out there's a seminal study on just that, and it's been proven to be a mainstay of thinking about retirement spending for the last several decades. It's called the "4% Rule."

We review the rule and then add in some newer thinking that has evolved the concept to make it more workable for today's retirees.

The 4% Rule

The challenge in retirement is finding a "safe" baseline withdrawal amount that will ensure funds last throughout retirement, then adjusting that number for inflation.

The 4% rule was developed in 1994 by William Bengen, a financial advisor concerned that the previous thinking about retirement withdrawals – a standard 5% - was unreliable. Instead, Bengen wanted to find a withdrawal rate that would be safe in any economic scenario, no matter how difficult.

Bengen used a 60% stock/40% bond portfolio for his research. He analyzed historical data on stock and bond returns from 1926 to 1976 to find what he felt was a safe first-year withdrawal rate that, paired with an inflation adjustment, would allow a portfolio to last for thirty years.

Instead of a Rule – Guardrails

The four percent rule doesn’t take into account investment performance. Several years of very strong market performance, particularly at the beginning of retirement, can increase invested capital significantly. Similarly, several years of negative returns may take time to recover from, and pulling income can crystallize losses and make it more difficult for a portfolio to recover.

The solution is to create guardrails. The guardrails pair the dollar value of the initial 4% with changes to the amount as a percentage of the entire portfolio's value. For example, suppose the baseline 4% of the portfolio is a $60,000 withdrawal, and in subsequent years the portfolio's value increases so that $60,000 is only 2% of the total portfolio value. In that case, distributions could be increased back up to 4%.

The upper guardrail would be if the portfolio's value decreased so that the annual distribution amounted to 6% of the portfolio. In that case, spending would be decreased down to 4%.

This approach works well to keep spending in line with the fluctuating value of the portfolio, but it doesn’t pair up with the reality of the average retiree’s spending, distributions, and income throughout their multi-decade-long retirement.

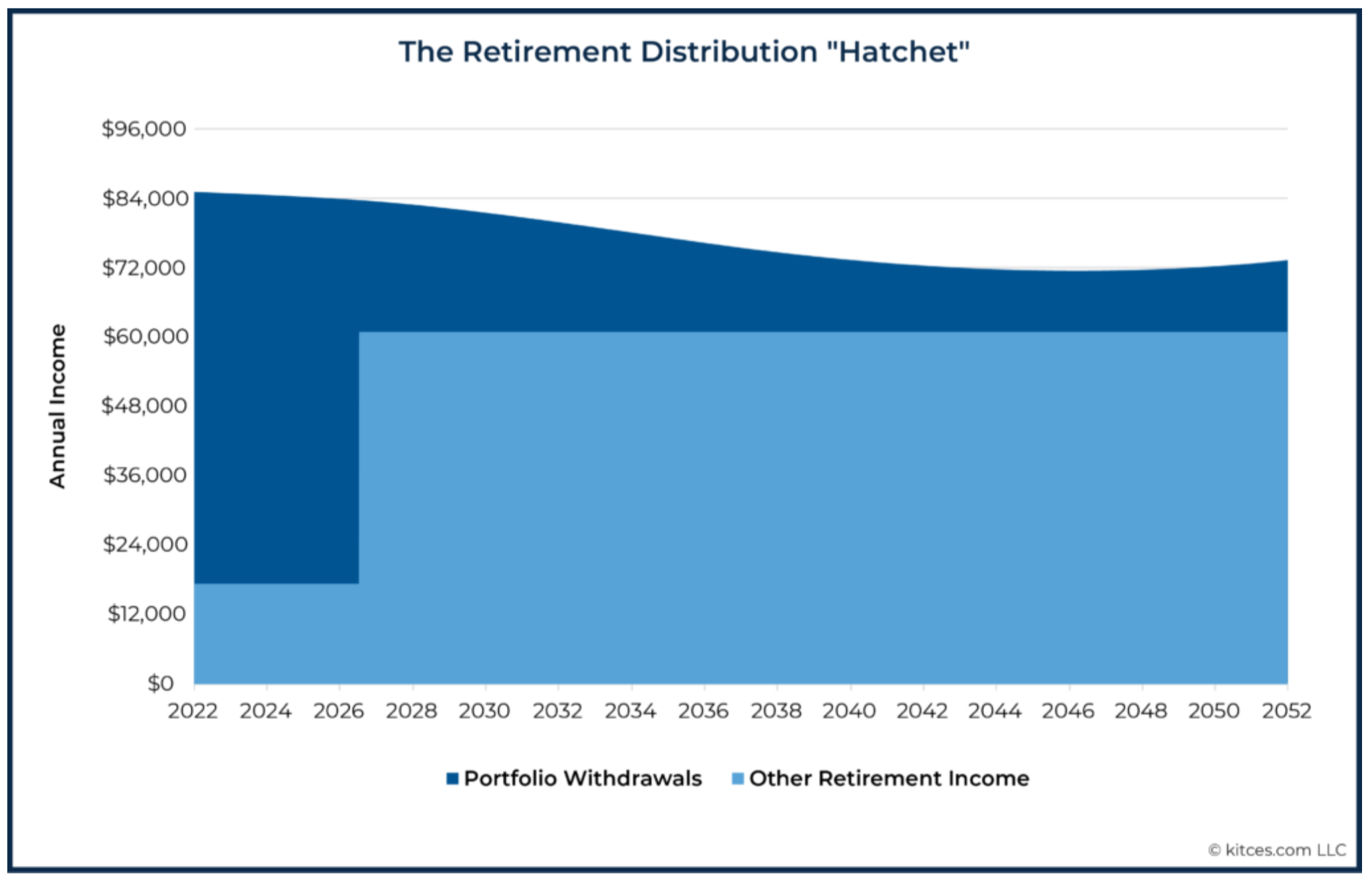

The Retirement Distribution Hatchet

Social security benefits can start as early as 62, and the full retirement age (FRA) for most people is between 65-67. Once you hit your FRA, benefits increase by 8% annually until age 70. This can be a big boost in social security benefits, and since 15% of social security is always tax-free, it can make sense to hold out as long as possible. In this case, the early retirement years are funded by withdrawals from investments.

The early years of retirement also coincide with the highest retirement spending, as folks are younger, more active, and more excited to partake of all the leisure activities they've been looking forward to.

This results in the Retirement Distribution Hatchet, so named because it looks like … a hatchet. (Hey, we’re money people, not creatives.)

Portfolio distributions are highest early in retirement, and then when social security benefits kick in, they displace the need to withdraw from retirement investments. That creates the blade of the hatchet. The hatchet's handle is made by the dip in spending often seen in later retirement as people age. There can be a slight increase in the last several years as health care spending goes up.

A Better Approach

Having a good underpinning of data to create a retirement withdrawal rate is a good start. But the reality is that a more flexible approach can fine-tune the retirement withdrawal number. Using tools to factor in longevity, expected future cash flows, changes in income (such as an inheritance), or changes in expenditures (such as buying a second home) can create a far more meaningful picture.

Layering on an analysis of risk to ensure that the portfolio is invested according to the risk profile that the investor is comfortable with is also something that should be factored in.

And finally, retirement is just like the rest of your life. It's complicated. Things happen. Your retirement withdrawal rate is just one element of a comprehensive financial plan. Structuring a plan that will ensure you get to live the life you want means building in the flexibility to make big changes efficiently. It means monitoring your portfolio, investments, plans, goals, and the markets and economic situation to ensure that everything stays on track.

So, what’s the answer?

As in most things in our world, it depends. First, we need to identify the ultimate goal for the investment portfolios: preserve capital, leave some for the heirs, or spend to the last penny.

The famous 4% rule targets preserving 100% of capital, and provides a withdrawal rate that can be (in theory) sustained to perpetuity. This of course can easily be challenged with the examples of retirement at the age of 65, it happens to be year 2007 and you have a 100% stock portfolio, or it’s 2001 and you’re heavily invested in tech stocks.

Another stress test would be during hyperinflation years of the 70s when the 4% amount this year needs to be 5% next, 6% after so on and so forth.

So, the first thing to pay attention to is not the withdrawal rate but rather the portfolio construction that is designed for retirement years. Such a portfolio should focus on income and capital preservation versus growth. This would save the investor from the financial demise of the two cases mentioned above, 2002 and 2008.

Second, this portfolio should be targeting the required withdrawal amount, not the withdrawal rates, with the least possible risk taken to reach the goal. If that is not achieved, risk levels should be gradually increased to hit the spending goal.

What happens if the spending goal is above 4%?

4% rule has its weaknesses but can still be used as a line in the sand to trigger the red flags that should open the doors for a heart-to-heart conversation.

Can the spending goal be reduced?

Is the client content with spending down the principal?

In many cases, the realistic answer to the above questions is yes.

What would happen if the withdrawal rate is at 8%?

Eventually, something will have to give. The client will either have to make important life decisions, or get comfortable with higher risk levels to shoot for the target. Here, it is also a good opportunity to mention Monte Carlo Analysis, MCA.

MCA is used to determine the probability of success in reaching set goals. The key thing here to mention is that in the event that the probability of success is, say below 80%, that doesn’t mean the goals are not met to their entirety. It only means that some adjustments may need to be made like decreasing retirement spending a bit, or retiring a few years later. Especially retiring a few years later can have a huge impact on a retirement plan because it has a double whammy effect. It reduces withdrawal years, and increases years of savings.

In short:

The focus of retirement spending should be the amount, not the withdrawal rate and the goal of the portfolio construction should be to reach that target with the least amount of risk possible.

If the withdrawal rate is above 4%, this can provide an opportunity to have a conversation and see how important preserving principal is. If it is not a priority, and if there is only a period of 15 years at retirement, even a withdrawal rate above 6% can be deemed safe.

So it all depends on factors such as the length of retirement, client’s approach towards preserving the principal and risk tolerance levels, all of which would surface during the financial planning process.

Hence the reason why it is in the hear of our practice and we strongly recommend having one drafted as part of our services we provide.