February Market Commentary

A New Administration Gets Down to Business

January Recap and February Outlook

January seemed to go on forever, as the country faced extreme weather and devasting wildfires. The new administration got underway with a lot of sound and fury, particularly around tariffs, which had been a highlight – or a wild card – of the campaign promises. This temporarily caused some market turmoil, but a reversal in short order seemed to validate the market’s perception that this business-oriented administration may have a bark that is worse than its bite.

At its late January meeting, the Federal Reserve paused as anticipated, but the accompanying statement was perceived as hawkish, leading to the belief that despite the new administration’s preference for lower-and-sooner rates, the status quo of higher-for-longer will likely remain in effect.

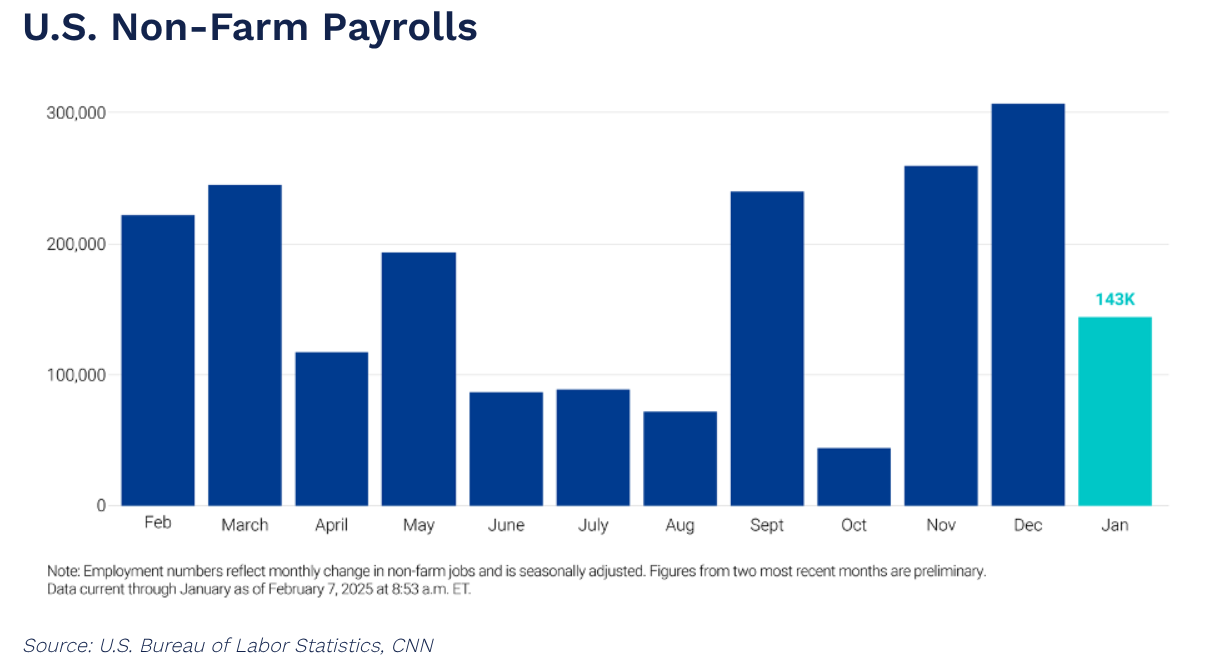

Let's get into the data: * Inflation, as measured by CPI, bumped up slightly. CPI rose 2.9% for the 12 months ended in December. This was in line with Dow Jones economists’ forecasts. * Non-farm payrolls for January came in at 143,000. The U.S. Bureau of Labor Statistics reported fewer than the 170,000 jobs that were expected, but the unemployment rate fell to 4%. * Consumer confidence declined. The Conference Board Consumer Confidence Index® declined by 5.4 points in January, following a decline in December.

* The Fed held rates steady. The key short-term rate remained in a range between 4.25%-4.5%.

What Does the Data Add Up To?

The new administration inherited a strong economy, if measured by data around GDP, labor markets and lower inflation. The Federal Reserve has room to assess future moves, even with a slightly weaker labor market reading in January.

Consumers, tired of the lingering effects of sky-high inflation that are continuing to be felt at the grocery store, and everywhere else, had a different read on the economy. This doesn’t appear to have lifted yet, as consumer confidence continues to decline. It’s important to note that The Conference Board reports that “Consumer confidence has been moving sideways in a relatively stable, narrow range since 2022.” January’s number was at the low end of that range, but it doesn’t mark a significant downward departure.

The first ten or so days of the new administration have been non-stop action, not always necessarily forward. That’s not necessarily bad news, yet. The Trump administration is taking a bold approach to policy and setting some big stakes in the ground, but the end result doesn’t appear to be much different than expectations. Tariff announcements on Mexico and Canada were met with cooperation in this round and are on hold for now. This is largely what the market expected. Even if some form of tariffs is eventually enacted, the threat of higher inflation and a cratering stock market has receded, for now.

There was some good news in the CPI data, as shelter costs, which have been slow to come down and make up a big component of CPI, experienced the smallest one-year gain since January 2022.

The Fed was mostly concerned about inflation at the January meeting and removed the language that inflation “has made progress” toward 2% that was present in the December statement. Instead, labor market conditions were referred to as “solid,” while inflation is “somewhat elevated.” The non-farm payroll data, even with lower unemployment, doesn’t shake the solid foundation of labor where the economy is concerned. It may not be the “weakness in the labor market” that Powell referenced would be necessary before resuming rate cuts.

Chart of the Month: A January Slowdown, But A Solid Labor Market Overall

Equity Markets in January

- The S&P 500 was up 2.70% for the month

- The Dow Jones Industrial Average rose 4.70%

- The S&P MidCap 400 increased 3.78% for the month

- The S&P SmallCap 600 was gained 2.85%

*Source: S&P Global. All performance as of January 31, 2025 * It was a strong January for the equity markets, and for believers in market lore, that would indicate a strong year is ahead of us. The canard of “as January goes, so goes the year” has been correct 70.8% of the time since 1929, according to S&P Global. The month reversed the dominance of the Magnificent 7 that closed out 2024, and gains were broad. Q4 2024 earnings to date are stronger than expected, with 179 issues reporting, representing 50.5% of market value. The beat rate is 77.7%, a historical high.

Bond Markets in January

The 10-year U.S. Treasury ended the month at a yield of 4.55%, down from 4.58% the prior month. The 30-year U.S. Treasury ended December at 4.80%, up from 4.78%. The Bloomberg U.S. Aggregate Bond Index returned -0.27%. The Bloomberg Municipal Bond Index returned -0.51%.

The information contained herein is intended to be used for educational purposes only and is not exhaustive. Diversification and/or any strategy that may be discussed does not guarantee against investment losses but are intended to help manage risk and return. If applicable, historical discussions and/or opinions are not predictive of future events. The content is presented in good faith and has been drawn from sources believed to be reliable. The content is not intended to be legal, tax or financial advice. Please consult a legal, tax or financial professional for information specific to your individual situation.

*This content not reviewed by FINRA *

Disclosure information

The strategies discussed are strictly for illustrative and educational purposes and should not be construed as a recommendation to purchase or sell, or an offer to sell or a solicitation of an offer to buy any security. There is no guarantee that any strategies discussed will be effective. The information provided is not intended to be a complete analysis of every material fact respecting any strategy. The examples presented do not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy. The information provided is not intended to be a tax advice. Investors should be urged to consult their tax professional or financial advisers for more information regarding their specific tax situations.